The cost of college today has put affordability truly out of reach for most Americans, including many who are comfortably middle class. I am not stating anything that someone who is currently putting children through college hasn’t realized. While higher education has always come at a cost, it has reached a price point that now exceeds the pain threshold for most Americans. As President Biden works to pass student debt relief programs, I sadly am of the opinion that the situation has no satisfactory solution that doesn’t involve drastically changing the delivery of higher education in this country. But that is a subject for another day. Right now I am consumed by the decisions families make with respect to cost and choosing a college.

The question that has been weighing on my mind is how much is too much to pay for college, specifically for schools that heavily discount tuition. Anyone who follows the news about rising college costs probably is familiar with the difference between the “sticker price” (what a college publishes as its total cost) and “net price” (what its students actually pay, on average). In recent years, most colleges have made a practice of offering merit aid to students they wish to lure away from more selective schools. Colleges do that by “discounting” the sticker price so that students feel like they are getting a real deal…but are they? The discounting of tuition, in fact, is one of the main drivers of higher prices. Colleges are able to offer select students sizable discounts by charging everybody else more. So should you pay full price for a college that uses your tuition dollars to subsidize other students?

The question has no simple answer. What makes sense for one student and family may be impractical for another. My goal here is to provide a framework for families wrestling with this question as they help their children make the all-important decision about where to attend college.

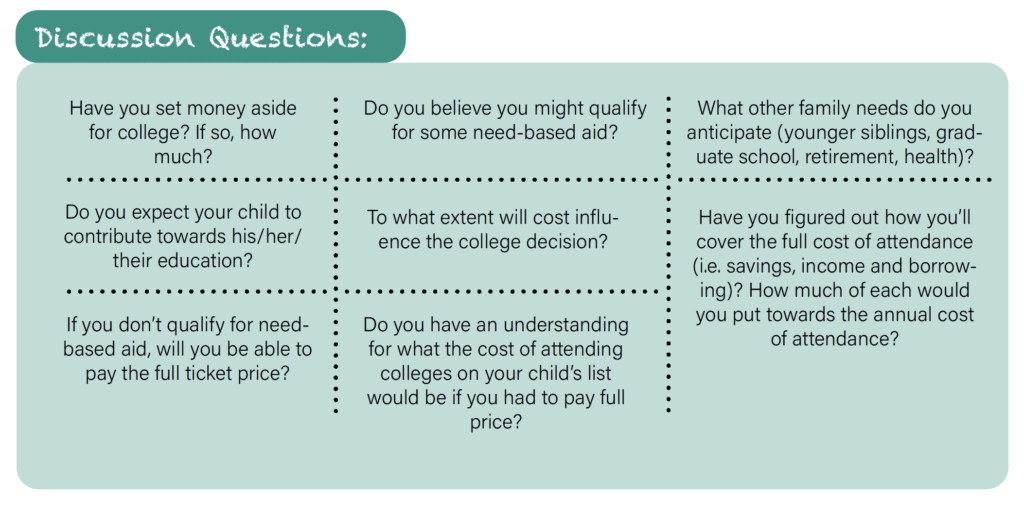

Have the family discussion and a joint understanding about affordability before the applications go out and the acceptances come in. It is okay to apply to the dream college, but be clear with your son or daughter about what kind of financial aid package, either need or merit-based, will make it feasible to attend. Setting expectations early may mean avoiding future heartbreak.

Recognize that loans may make it possible to attend the college of choice today, but that excessive borrowing will feel like an albatross around the neck once graduation has passed and the loan payments come due. Borrowing a reasonable amount to pay for college makes sense, but knowing what is affordable requires planning and forward thinking. How much will the student and/or parents probably have to borrow over four years? What will be the approximate size of the future graduate’s monthly payments and how long will it take to pay off the loans? Given a student’s career plans, what will he or she likely earn, and will that be sufficient to comfortably meet debt payments while still covering other living expenses? A good rule of thumb is to keep debt payments at or below 10% of gross income. Calculators such as those available on the website Mapping Your Future enable one to project future debt payments, based on expected borrowing and interest rates. The calculators will also help you determine what a person should earn in order to comfortably pay back a given balance in student loans. If you are looking for a way to estimate average salaries in a specific field by region, you might want to check out the Bureau of Labor Statistics site.

Think it through before you pay the sticker price at a college that heavily discounts tuition. If a school discounts tuition for a significant number of students and you are not one of them, here are some reasons the price might be justified:

1) It’s the dream school and you can afford it without borrowing 2) The student wants to pursue a unique major or program for which the college is renowned

3) The college offers some merit aid, but most students pay full fare (the “subsidizing of other students is not significant)

4) Other less expensive options truly do not meet the academic needs of the student

Have your child include schools on the college list that will likely offer tuition discounts based on his or her test scores and GPA. For the most part, you can figure out which colleges these are. Are your child’s test scores and GPA at the high end of the school’s range? In all likelihood, the college will offer some discount as an incentive to entice your student to attend.

Weigh the emotional against the practical. Does it make sense for the middle income family that receives no need-based aid to choose the Ivy League or highly selective university over the state school option? Given the emotions wrapped up in these types of choices, I find it difficult to advise others on the right and logical decision. Choosing the highly selective, name brand college may indeed change the student’s life, but at a high cost if excessive borrowing is involved. This is especially true if a student has plans to go on to graduate school. I know it’s hard to turn down Harvard or Yale, and I’m not saying you should. However, graduating debt-free or with limited loans is anything but over-rated. Do well as an undergraduate anywhere and you can spend the bigger bucks on graduate school.

Deciding what a college education is worth is a complex analysis, yet unlike an integral calculus problem, there is no single right answer. My hope is that having a framework to evaluate this decision and a list of questions to ponder will help each family come to the answer that is appropriate for them.